Is the current state tax structure unfair? Washingtonians are not very trusting of government promises

Are taxes in the state of Washington unfair? Currently there are discussions and battles on many fronts regarding taxes, including a “capital gains” income tax, school taxes, per mile taxes and tolls to drive on highways and bridges, and property taxes. Here in Clark County, there is a 0.1 percent sales tax increase on the November ballot to fund body cameras for law enforcement officers and a new jail.

Against this backdrop, citizens are discussing the lack of “affordable housing” and “fairness” for seniors and people on fixed incomes being able to continue living in their homes as property taxes continue to rise. People are told the government can only increase taxes by one percent a year, yet that never seems to happen when citizens open their property tax bill.

Washington’s small businesses regularly talk about the unfairness of the Business and Occupation (B&O) tax, which does not tax profits, but every dollar a business takes in regardless of profit or loss.

During a Southwest Washington discussion about the state’s tax structure, multiple examples were offered for discussion of changes that would neither increase nor decrease the total amount the state takes in. Yet several local citizens lamented the lack of an incentive in the discussion for government officials to be fiscally responsible.

Darlene Johnson owns Woodland Truck Line along with several other businesses. She said business owners are “concerned that if we opt for either an income tax or a margins tax, that we’ll end up with both. Government seems to have an appetite for spending to the point that they’re always going to want to increase the budget. So saying it’s revenue neutral doesn’t make me feel warm and fuzzy.”

“There’s no trust here,” said Ron Arp of Identity Clark County. The business owners he represents were shocked at the sudden appearance of a capital gains tax last year.

In recent years, state legislatures in both Oregon and Washington have claimed the need to change their tax structure. Oregon lawmakers claim their income tax revenues are too volatile, and point to the need to have a sales tax like Washington for stability. Washington legislators claim their state’s reliance on sales and property taxes are too regressive and unfair, and point to the need to have an income tax like Oregon.

How can each state claim their system is “unfair” or “unreliable” and point to the other state’s system as “better?’’

In 2017, the Washington State Legislature established the Tax Structure Work Group (TSWG) to identify options to make the Washington state tax code more fair, adequate, stable, and transparent. The TSWG is composed of bipartisan Washington State legislators, as well as representatives from Gov. Jay Inslee’s office, the Washington State Department of Revenue, the Washington State Association of Counties (WSAC), and the Association of Washington Cities (AWC).

Is Washington’s tax system and structure fair? Is it equitable? Is it stable and is it adequate? Those are the questions the group is seeking to answer with input from citizens. The end goal of the effort is to potentially offer legislation in 2023 for the state legislature to consider enacting into law.

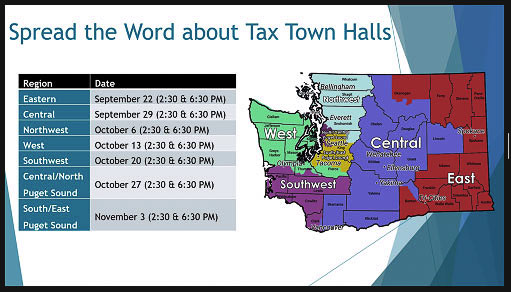

Wednesday, the TSWG held two meetings for Southwest Washington citizen participation and input, via online zoom meetings. This is part of a statewide effort to solicit citizen input. These “Tax Town Halls” are scheduled for different regions, but you can attend and offer input on any meeting, regardless of where you live. In total, there will be 14 town hall events around the state, with four remaining.

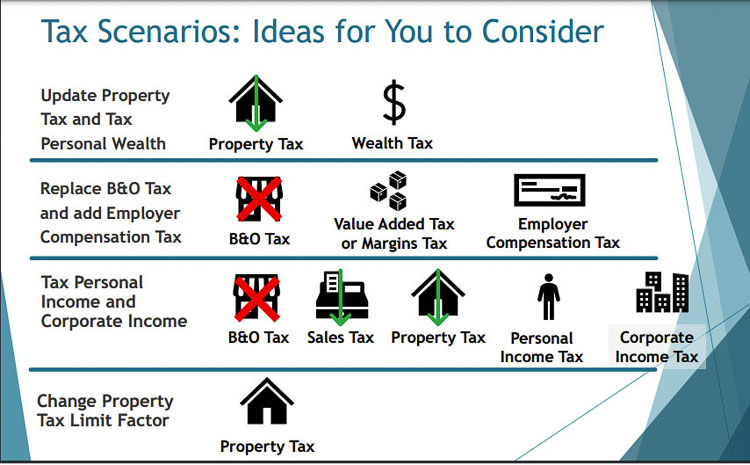

The TSWG examines several issues to improve Washington’s tax structure. For example, the TSWG explores:

- Potential alternatives to sales and property taxes, to reduce disproportionate impacts on low- and middle-income households.

- Potential alternatives to the business and occupation tax to reduce disproportionate impacts on small, start-up and low-margin businesses.

- Methods of taxation that could help modernize the Washington state tax code to reflect the changing, 21st century economy.

- Methods of taxation that simplify state tax structure, reducing the need for excessive individual preferences which currently number 748.

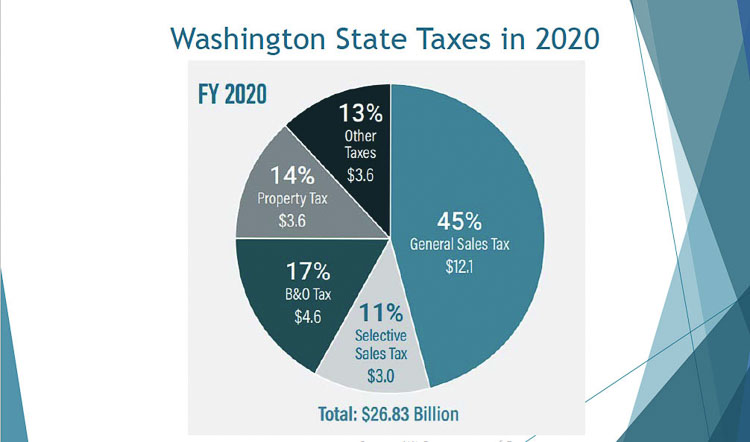

In 2020, the state’s General Fund took in $26.8 billion in tax revenue. The sales tax provided 45 percent of those funds. “Selective sales taxes” like special alcohol and marijuana taxes provided 11 percent of revenue. The B&O tax provides 17 percent, and 14 percent comes from property taxes. Finally, 13 percent of state revenues come from “other” taxes and sources.

The TSWG will also consider how alternatives might affect the state’s economic vitality and how alternatives relate to neighboring states’ tax systems.

The TSWG facilitates public discussions throughout the state about the advantages and disadvantages of the state’s current and potential tax structure to inform recommendations to improve Washington state’s tax structure to benefit individuals, families, and businesses in Washington state.

The overall effort is to not increase or decrease revenue to the state, but to consider changes to how that revenue is raised. Furthermore, this is only discussing the state’s General Fund budget. The state also has a Capital Budget and a Transportation Budget.

The workgroup is exploring a wealth tax on individuals with $1 billion or more in assets. It was revealed that there are just over 100 people in the state with wealth at that level. The proposed creation of the wealth tax would allow the state to reduce property taxes. Recently Sen. Lynda Wilson (Republican, 17th District) has spoken about a change exempting the first $250,000 of a person’s primary residence.

Sen. Phil Fortunato suggested citizens would benefit from hearing a “pro” and a “con” statement about each of the options, to better prepare them to provide more informed input to the TSWG.

The organizers gave citizens the opportunity to go into one of two breakout rooms. One discussed individual taxes and the other discussed business taxes.

Individual tax discussion

In the individual tax breakout room were citizens from Vancouver, Battle Ground, Camas, Ridgefield, and rural Clark County. There were also a few from other areas in the state.

The “wealth tax” was a 1 percent tax on assets held by individuals with $1 billion or more. They believed this would allow the legislature to exempt the first $250,000 in taxable value for your primary residence, but just for the state portion of your property tax bill. Your school taxes, your city and county taxes would remain the same.

One participant asked “what guarantee is that over $1 billion would not become $1 million when more is needed?” The staff response was “this is just an idea, and there’s no legislation that creates official safeguards.”

Some supported the perceived “fairness” or “equity” of the wealth tax allowing a reduction in taxes for the poor. “Many people who have a home and pay a mortgage the property taxes is a real burden on them,” said Verna. “Whereas the wealth tax as a small percentage of their overall wealth wouldn’t be as much of a burden.”

Comments typed in the chat box included concerns about the “slippery slope” of the high wealth tax that could become an income tax on the average citizen.

“I just have a trust issue with the way the legislature has done taxes in the recent past,” said Richard. “Even when the population votes against a tax, the legislature tends to pass it. So I have no trust that they would do what they say they’re going to do.”

Dan shared the analogy of the camel’s nose getting under the tent, regarding any income or wealth tax. “Once the head is in the tent, the rest of the camel follows.”

“I think everybody who’s educated knows how the US income tax started at 1 percent, just on millionaires back then,” he said. “It has subsequently gotten to a higher percentage and affects virtually everybody.”

Another citizen echoed Richard’s concern, saying people felt there was a “bait and switch” in the promised 30 percent reduction in local property taxes as part of the “McCleary solution” in education funding. People are now paying more than ever.

The staff comment was that they’d heard similar comments from around the state.

Edri Geiger states that she is politically liberal, and has served on school boards. Yet she expressed concerns about citizens not seeing all the ramifications of the proposed changes in taxes.

She spoke about individuals who live in Southwest Washington because of our current, favorable tax structure. “When we are thinking of increasing their taxes, we lose the incentive for them to come and work here and put businesses here; which means jobs and wealth for Southwest Washington,” Geiger said. She was concerned about the negative impacts that could happen as a result of changes.

One citizen mentioned knowing several local businessmen in Southwest Washington that are looking to move out of state because of the discussion of a capital gains income tax by the state legislature. “Money is totally flexible and fluid,” he said. “It can move anywhere you want, not only in the United States, but around the globe. So for a billionaire or multimillionaire, it is absolutely nothing to suddenly move their corporation to another state or another country.”

Several people expressed concerns about border communities, those along the border with Idaho, Canada, and Oregon. These people can choose which taxes they pay and which state they like the best.

The TSWG staff put together a web-based calculator citizens can use to turn the abstract ideas into some possible numbers for their situation. Click here. Note that the tax changes are only for state taxes (especially property taxes) so city, school, and county taxes remain unaffected.

Staff reminded participants there was also another breakout room, where corporate taxes and the B&O tax was being discussed.This conversation is part of a larger puzzle,

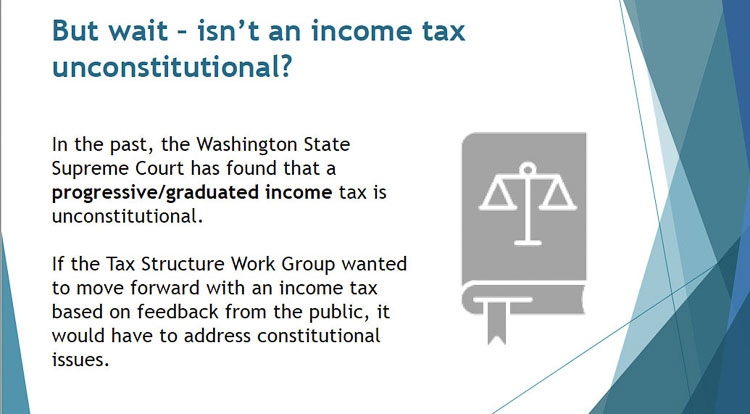

In discussing income taxes, a flat tax would be all people’s income would be taxed at the same flat rate. The Department of Revenue modeled all this to be revenue neutral.

If the state introduced a personal income tax of either a 3.7 percent flat tax, or a range of 2.1 to 4.2 percent, as a progressive tax, depending on one’s income, it would mean that the state would be able to decrease its portion of the sales tax from six and a half percent to four and a half percent. That’s a 2 percent reduction. It will be able to maintain that same deduction of $250,000 of assessed value of the place where you live for the state portion of property taxes.

Citizens asked for the definition of “income” and staff indicated it would be the “adjusted gross income” from one’s federal tax return. People noted a lot of the “Microsoft millionaires” and hi tech workers don’t necessarily have large W-2 incomes, but instead get lots of stock options, and other types of compensation.

Deborah thought a progressive tax would be more fair.

Richard supported a flat income tax, but “only if the percentage were written into the constitution and could not be changed without a vote of the people.”

Geiger reemphasized the unintended consequences of a change to an income tax. “We will lose financially, from our businesses and the people that are here to provide jobs,” she said. “A lot of the new companies moving in have come here because of our tax structure for the people as well as for their businesses.”

She would hate to see the advantage people see in Washington’s lack of an income tax disappear. Geiger fears our fast growth would stop and many people would return to living in Oregon should Washington adopt an income tax.

One person referenced the fact that King County attitudes tend to make decisions for the entire state. “When they have discussions, they still forget about Southwest Washington, and I am disturbed by them.”

Sharla lives in King County, but was participating in this session. Her cousins live in Battle Ground and in Vancouver. “They can’t afford to pay more taxes and should not pay more taxes,” she said. “But my neighbors in King County can and should pay more.”

Brad said: “You’re asking us to make a choice between two very bad alternatives. I need to go on record and say neither. I don’t want the legislators to feel like there was support for either a flat or progressive income tax.”

Martha said she favors a progressive income tax. “We should have a more stable tax structure in our state,” she said. That prompted one participant to type in the chat room — when has income to the state not been stable?

She also commented about the number of people that shop in Oregon, saying they don’t pay their fair share of sales tax. Mark added to Martha’s comment by speculating that Southwest Washington is losing 15 to 30 percent of revenue due to local residents shopping across the river.

The staff member remarked about the uniqueness of border counties, and how people get to pick their own tax structure. They then wondered aloud that “if” the state were to lower the sales tax, would fewer people cross into Oregon to shop.

Regarding cross river issues, one citizen noted that Oregon is claiming their system is too volatile and unfair, and that they need what Washington has — a sales tax. Yet Washington says their system is unfair and that they need what Oregon has — an income tax. How can both be true? Or are they mutually exclusive?

It was noted that in the pandemic, Washington state’s revenues as a whole did not plummet at all, in spite of people being laid off and facing unbelievable hardships. Revenues to the state are actually higher than ever.

The state got more than its fair share of money and the people would just like to keep more of their money, said one person, But people being allowed to keep more of their money is not one of the scenarios offered.

“My feeling is that the federal income tax is a very fair graduated tax,” said Bob. “In fact, people making less than $32,000 a year don’t pay any federal tax. My proposal is to simply eliminate all of the state sales tax, including the gas tax, and just have a graduated income tax that will simply piggyback on the federal tax.” He believes the sales tax is too regressive.

Geiger asked if the group has gone to other states and done surveys about what they thought about their existing tax proportionality, and how that impacts them. She also asked to look at Oregon and their “kicker” program. When they take in more than they budgeted, they give the money back to the people. She mentioned that happens every year.

“I’m not saying it’s a good thing or a bad thing,” she said. “But because they got a push back from their people, they instituted that.”

Dan noted the wealthiest people typically arrange not to have any income, from a tax perspective. “They can structure in a way that they don’t have any income.” The income tax creates disparities for the people in the middle. He mentioned “the poor people don’t pay any income taxes and they don’t have any skin in the game,” which concerns him.

The current tax system limits growth in property taxes to 1 percent a year, plus “growth” or new construction. Should the state remove the 1 percent limit and increase it to 2 or 3 percent? Or alternatively, should they revise the limit with adjustments for population growth or inflation?

One participant pointed out in the chat box that this scenario would allow the size of the pie to grow, whereas the other discussions were supposed to be “revenue neutral”. Richard noted that legislators would “love” this scenario because they could grow revenues by 6 percent since we’re currently seeing 5 percent inflation.

Stephen expressed concerns about senior citizens and those on fixed incomes. Their property tax burden grows year after year, indefinitely.

“When we talk about things about what’s fair, how is that fair?” he asked. “Somebody has worked and purchased their home, they live there and that’s all they’re doing. But yet every year, they need to pay more to the state for services, simply because they have to have a place to live.”

“You wanted to talk about revenue neutral, but where’s the incentive to actually use the dollars that are there more effectively,” asked Stephen. “Because if we continue to set a program where we’re always looking to get more money, then there’s never an incentive to turn around and say, hey, let’s stop doing the things that might not be very effective. Let’s rethink the way we do things and see if we can resolve problems, rather than just continue to balloon and create larger ones over time.”

Geiger spoke about fiscal responsibility and her experiences from being on the school board. She had colleagues who thought that $100,000, $200,000, $300,000 was something they weren’t supposed to question because it was so little.

At the state legislature, she saw programs expand as more and more money came in. There’s always a downturn and when the downturn comes the programs have to be cut. Geiger fears elected representatives sometimes disregard being fiscally responsible because they are simply talking in numbers.

She echoed Stephen’s concern about property taxes impact on people. “They will remain the same, even in a downturn.”

In the wrap up, staff noted people can take an online survey as well as participate in any of the additional workshops scheduled.

People can view the entire slide deck here, and can also have discussions with their elected representatives. There is a 36-page booklet they have produced with additional background.

It should be noted the “other” breakout session covered business taxes. Therefore to get the flavor of both, one would have to attend multiple sessions. The business tax discussion was covered by TVW and can be viewed along with the introduction here.

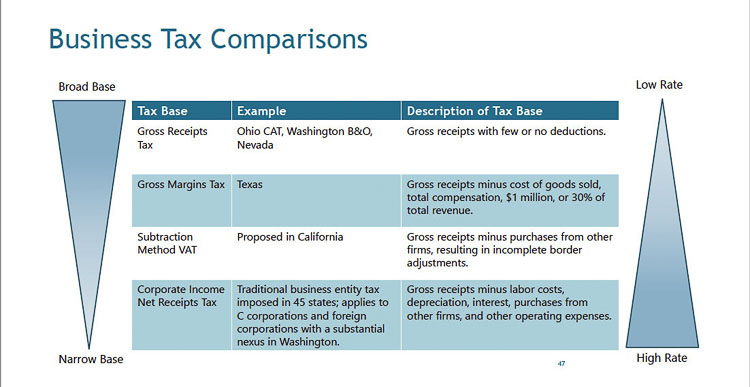

The short takeaway was businesses did not like a value added tax (VAT) and were sceptical of government “promises” to be revenue neutral. They feared a promised elimination of one tax in favor of a new tax, would result in both taxes being imposed and hurting businesses.

Jennifer Baker, president of the Columbia River Economic Development Council (CREDC) indicated they were worried changes would negatively impact our competitiveness to attract businesses and job creators and therefore grow the tax base.

Arp said “we’re not crazy about a gross revenue tax, especially in a border community.” He too was concerned about people changing their behavior regarding business and commerce if the wrong changes were made.

“I think we all were taken a little bit by surprise a year ago, when suddenly we had a capital gains tax on the table,” he said. “It’s going to have to wind its way through the courts. That is a significant shot and a very difficult one that changes our competitiveness significantly.”

When it comes to trust, he said “there’s no trust here.”

Elected representatives listening in on the discussions included the 17th District’s Lynda Wilson, Vicki Kraft and Paul Harris, 49th District’s Monica Stonier and Vancouver Mayor Anne McEnerny-Ogle, 20th District’s Ed Orcutt, Peter Abbarno, and John Braun; Phil Fortunato from the 31st District.

Also read:

Sen. Lynda Wilson’s plan for property-tax relief gets boost from latest revenue forecast