Officials Sept. 16 voted to adopt both the proposed budget, which has expenses totaling $54.5 million, and the proposed tax rate of $0.536448 per $100 valuation.

City Council managed to eliminate approximately $1 million in expenses through line-item scrutiny over the last several weeks, reducing total expenditures in the budget from $55.5 million to $54.5 million.

"We believe this conservative approach will meet the needs of our residents and improve the financial position of the city, not only for this year, but also for the years to come," City Manager Warren Hutmacher said in a letter to council.

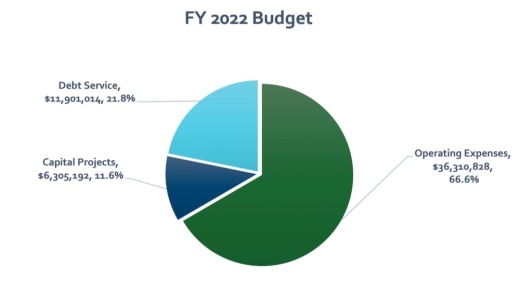

Of the $54.5 million in expenditures, operating expenses—the day-to-day costs of city services and operations, including salaries, equipment and utilities—account for $36.3 million.

Council budgeted $6.3 million for capital projects, and the remaining $11.9 million is set aside for servicing existing debt obligations.

The individual departments with the highest budgeted expenditures are Hutto Police Department with $6.3 million, streets and drainage with $3.5 million, and planning and development services with $1.8 million.

The approved $0.536448 tax rate is a decrease from last fiscal year’s rate of $0.60, but the city expects to bring in $2.4 million more in property taxes compared to last fiscal year, a 19.8% increase. Of that additional tax revenue, $1.2 million is to be raised by new properties.

As the no-new-revenue rate, $0.536448 represents the rate at which the city can expect to bring in no more tax revenue than the prior year before taking into account new construction.

This means most homeowners can expect little change in the amount of property tax they pay next fiscal year, according to Mayor Mike Snyder.

"I think we're the only city [in the area] that's not raising taxes on people," Snyder said.

Williamson County maintains an online property tax database, where property owners can view how different proposed tax rates would affect their tax bill based on current property values.